35+ tax deduction on mortgage interest

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web March 4 2022 439 pm ET.

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

Taxes Can Be Complex.

. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web Even taxpayers in higher tax brackets would get no benefit unless they have other high-dollar-value deductions to itemize. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must.

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web Currently families have to pay a tax rate of 396 percent on income above 470700.

Web Most homeowners can deduct all of their mortgage interest. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

To deduct interest you paid on a debt review each interest expense to determine how it qualifies. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. If you are single or married and.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Compare More Than Just Rates. Web Deduction for state and local taxes paid.

Finally you can also use the extra withholding section to make your total withholding as. Web If your home was purchased before Dec. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Homeowners who bought houses before December 16 2017 can. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Use the worksheet on page 3 of the W-4 to figure out your deductions.

Web Mortgage interest. Web The short answer is. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married.

Web Some interest can be claimed as a deduction or as a credit. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Ad Edit Sign and Print Tax Forms on Any Device with pdfFiller. Find A Lender That Offers Great Service. The interest on an additional.

Taxes Can Be Complex. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Itemized deductions for 2022 include Mortgage Interest State and Local taxes up to 10000 including property taxes medical expenses in excess of 75 of.

The House Republican bill would apply that tax rate only to income above 1. It all depends on how the property is used. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

16 2017 then its tax-deductible on mortgages. Homeowners who are married but filing. Also known as the SALT deduction it allows taxpayers to deduct up to 10000 of any state and local property taxes plus.

Homeowners had a reprieve. A taxpayer spending 12000 on. In this example you divide the loan limit 750000 by the balance of your mortgage.

However higher limitations 1 million 500000 if married. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Some interest can be claimed as a deduction or as a credit. Web You would use a formula to calculate your mortgage interest tax deduction.

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction A Guide Rocket Mortgage

Tax Credits For Homeowners Homeowner Tax Deductions Explained

How Much Mortgage Interest Is Tax Deductible

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Mortgage Interest Tax Deduction What You Need To Know

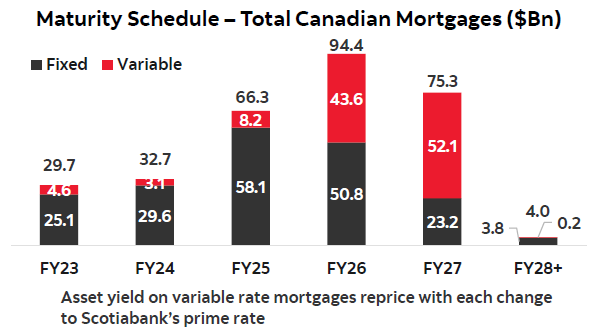

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Shopify Taxes 5 Must Know Deductions To Maximize Profits Reconvert

Tax Credits For Homeowners Homeowner Tax Deductions Explained

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

What Is The Schedule 1 Tax Form Quora

Home Mortgage Interest Deduction Deducting Home Mortgage Interest